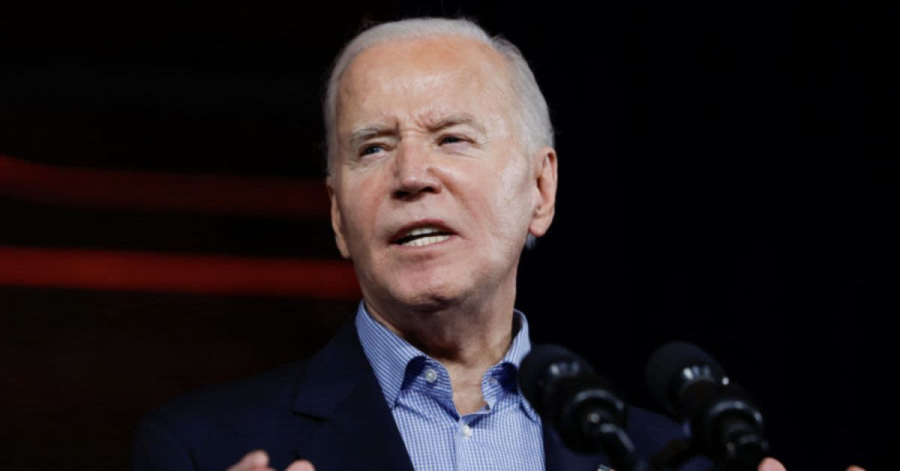

In a move that was expected, President Joe Biden unveiled his budget proposal for the election year on Monday.

The proposal, which calls for a whopping $5.5 trillion in tax increases, primarily targets the wealthy and corporations. The funds raised are intended to boost spending on federal benefits programs, affordable housing, and student loan cancellation, among other initiatives that are typically associated with progressive politics.

The budget proposal totals an astounding $7.3 trillion. This is a clear reflection of the Democrats' long-standing policy of taxing and spending. It begs the question: Can anyone name a single country or government that has achieved prosperity through excessive spending? The answer is a resounding no.

WATCH RFK JR.: BIDEN MUST SHOW COGNITIVE CAPACITY AND MENTAL ACUITY

Despite the fact that Biden's budget proposal has virtually no chance of passing the House, it serves as a stark reminder of the futility of repeating the same actions and expecting different outcomes. As is often the case with Democrats, when the proposal inevitably fails in the House, they will likely resort to blaming Republicans, including former President Donald Trump, for its downfall.

WATCH: POPE FRANCIS URGES UKRAINE TO EMBRACE NEGOTIATIONS AS KEY TO ENDING CONFLICT WITH RUSSIA

Brian Riedl, a senior fellow at the Manhattan Institute who specializes in budget and tax issues, spoke to the New York Post about Biden’s 2023 proposal. He described it as representing “the highest peacetime burden in American history, as well as the highest sustained taxes in American history.” Riedl suggested that Biden is intent on surpassing this already dubious record.

FORMER HOUSE SPEAKER NEWT GINGRICH GIVES BLUNT SOTU VERDICT

The president is not only increasing taxes but is also allocating a significant portion of the revenue to new spending rather than deficit reduction. This approach will inevitably lead to even larger tax hikes in the future when the deficit needs to be addressed.

WATCH: DANA CARVEY DOES THE BEST BIDEN IMPRESSION

In his divisive State of the Union address last Thursday, Biden proposed raising the corporate tax rate by 28 percent. This would increase the minimum corporate tax rate from 15 percent to 21 percent. The president also took a swipe at billionaires, whom he appears to view with disdain.

FIRE AND FURY: HAITI'S DESCENT INTO ANARCHY, PRIME MINISTER'S FATE HANGS IN THE BALANCE

Riedl disputed Biden's claim that billionaires pay an average federal tax of 8.2 percent, describing it as "essentially made up by White House economists" and “widely debunked.” He explained that this figure does not take into account the corporate and estate taxes paid by the wealthy. It also includes unrealized capital gains that will be taxed in a future year.

BUSTED: FLORIDA AUTHORITIES NAB SUSPECT FOR TERRORIZING JEWISH COMMUNITY MEMBERS

Biden's proposal also includes a record-breaking $258 billion request for affordable housing and up to $10,000 in new tax credits for first-time homebuyers. Riedl predicted that this would lead to an increase in home prices by stimulating demand from first-time buyers.

CAUGHT IN THE ACT: BRAZILIAN WOMAN POSES AS DOCTOR WITH $8 ONLINE DIPLOMA

House Speaker Mike Johnson (R-La.) issued a statement criticizing Biden's proposal, describing it as a clear indication of the administration's reckless spending habits and the Democrats' lack of fiscal responsibility. He argued that Biden's budget is not just off the mark, but a roadmap to accelerate America's decline.

HILARIOUS: WATCH COMEDY LEGEND NAIL BIDEN IMPRESSION ON PODCAST

However, the blame does not solely lie with President Biden. The real culprits are the 1,000 billionaires and profit-driven corporations in America. Meanwhile, Biden's runaway spending train, laden with money, continues to speed down the tracks.

This article was sourced from RVL1-AM